In the vast landscape of financial institutions, Khushhali Microfinance Bank Limited stands out as a beacon of support for individuals seeking financial assistance. Khushhali Bank loan for government employees was Established with a mission to alleviate poverty and empower entrepreneurs.

Khushhali has become synonymous with reliability and trust. First of all khushhali microfinance bank login and open khushhali bank online apply at www khushhali bank com pk.

Khushhali Loan Online Apply

Microfinance plays a pivotal role in fostering economic growth by providing financial services to individuals who lack access to traditional banking. Khushhali Microfinance Bank recognizes this significance and has been at the forefront of driving positive change through its tailored financial solutions.

Khushhali Bank Gold Loan

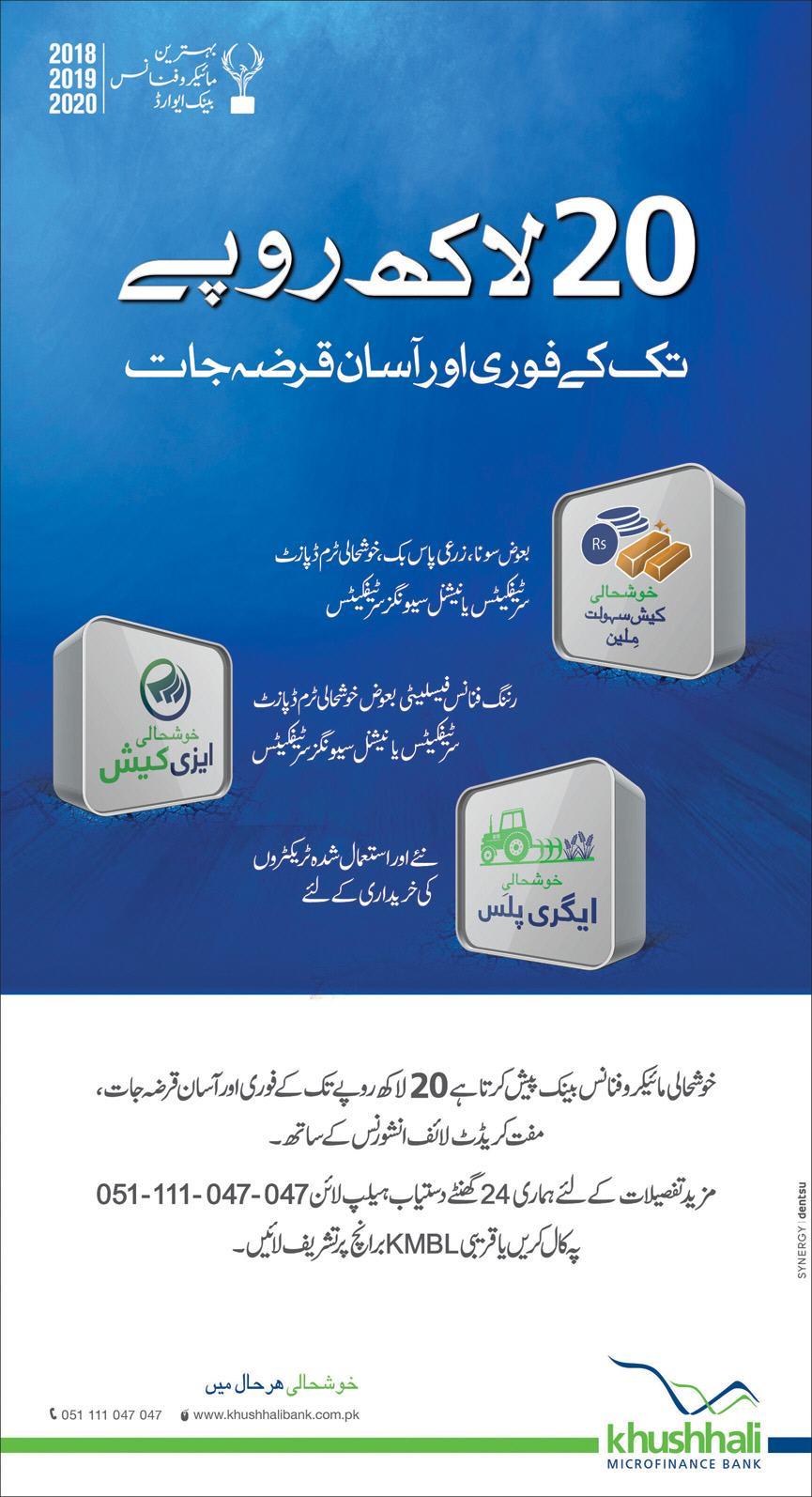

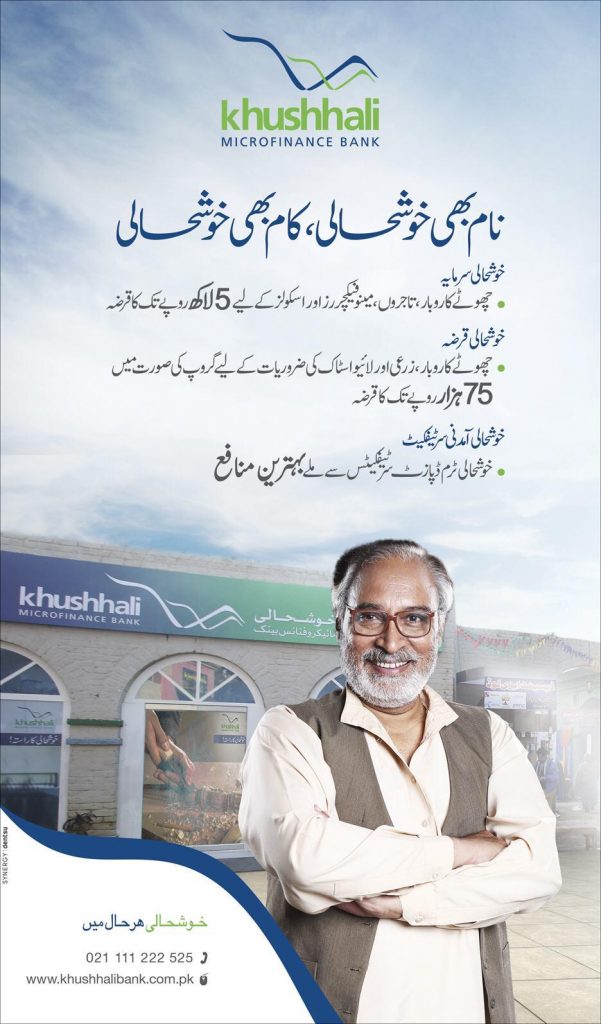

khushhali microfinance bank limited products included Loans in three categories Like GROUP LOAN consists of Khushhali Qarza and Khushhali Asaan Qarza. INDIVIDUAL LOAN Consists on Sarsabz Karobar, Khushhali Cash Sahulat, Khushhali School Loan, Khushhali Qarza Plus, Khushhali Livestock Loan, khushhali bank student loan & Shandar Bachat Scheme.

Khushhali Bank Loan Details

Khushhali Microfinance Bank offers khushhali bank salary loan, catering to the varying needs of its clients. Whether it’s a business loan, agricultural loan, or personal loan, the bank has options that suit different financial requirements. khushhali bank owner name is Aameer Karachiwalla (President/CEO).

Eligibility Criteria

Before delving into the loan application process, it’s essential to understand the eligibility criteria set by Khushhali Microfinance Bank. This ensures a smooth and efficient application process, saving time for both the applicant and the bank.

Khushhali Bank Loan Scheme

Khushhali Microfinance Bank has streamlined its loan application process, making it convenient for applicants. The online application system has become a game-changer, providing accessibility and ease to those seeking financial assistance.

Khushhali bank Loan Requirements

Applying for a loan online has become a popular choice for many, and Khushhali Microfinance Bank embraces this trend with its user-friendly online platform. The advantages of online applications include convenience, time-saving, and the ability to complete the process from the comfort of one’s home.

Khushhali Microfinance Bank Limited stands as a beacon of financial support, offering a seamless and secure online application process. The bank’s commitment to empowerment, coupled with its user-friendly approach, makes it a preferred choice for those seeking financial assistance. Embrace the opportunity for financial growth with Khushhali Microfinance Bank.

- khushhali bank helpline Number: 021-3245-5548

- khushhali bank contact number : 021-99221935

- Fax: 021-99221154.

AWAM PK – Current Jobs & News for Awam of Pakistan AWAM PK Latest News, Results, Jobs, Sports, images, All Prices in Pakistan

AWAM PK – Current Jobs & News for Awam of Pakistan AWAM PK Latest News, Results, Jobs, Sports, images, All Prices in Pakistan