A reduction in the registration fee for old models of unregistered iPhones has been announced. The Federal Board of Revenue had announced last month a reduction in PTA taxes on all Apple smartphones, which has been implemented.

A reduction in the registration fee for old models of unregistered iPhones has been announced. The Federal Board of Revenue had announced last month a reduction in PTA taxes on all Apple smartphones, which has been implemented.

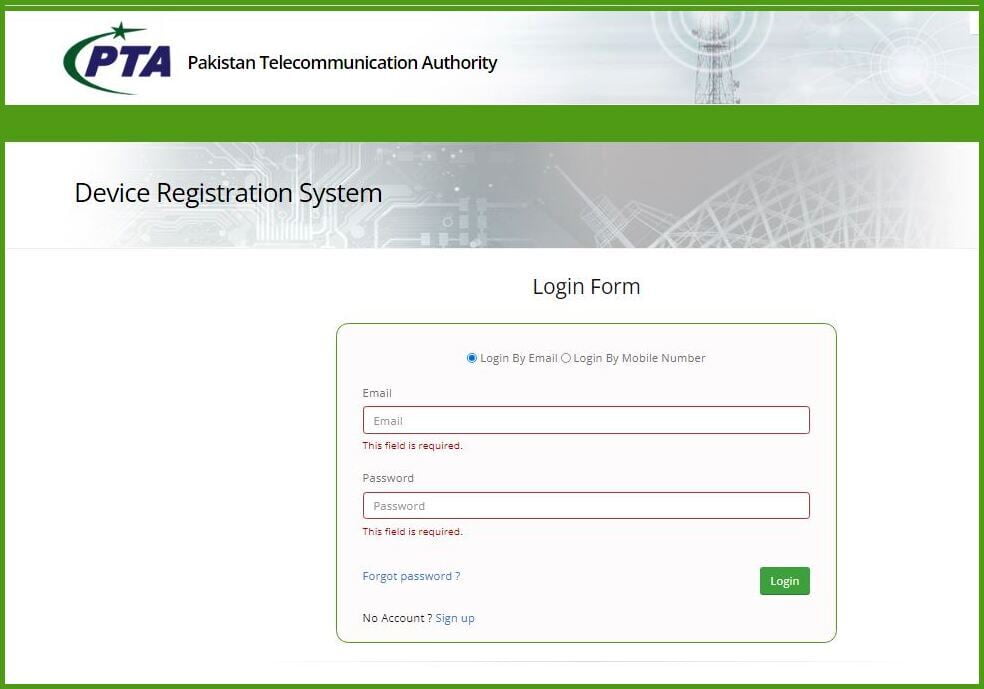

PTA has announced a separate reduction on passport and NIC, after which the fee for iPhone 8 on passport will now be Rs 38,922. Mobile user Check How to Check Online PTA Approved Mobile in Pakistan

PTA Mobile Registration Tax

The PTA registration taxes of various brands of imported mobile phones have been increased from Rs 15,000 to Rs 70,000. Fixed sales tax on mobile phones worth more than 200 200 imported from abroad has been abolished and sales tax has been imposed at 17% of the price ratio.

However, the previous fixed rate of customs duty on imported mobile phones of different categories will be maintained. Many people know to apply for PTA Online Mobile Registration at CMOs’ Franchises/Service Centers in Pakistan.

PTA Mobile duty and tax rates

The Federal Board of Revenue (FBR) has issued new duty and tax rates on mobile phones after Finance Supplementary Bill as buyers now will have to pay 17 percent sale tax along with tax and duty on phones.

The duty and tax rate on mobile phones worth US$30 will be Rs430. But, the duty and tax rate on mobile phones worth up to $100 will have to be Rs3,200. Similarly, 17 percent sales tax and tax of Rs27,600 will have to be paid on mobile phones worth more than $500 dollars.

Moreover, duty and tax rates were also issued on the purchase of mobile phones on National Identity Card. Duty and tax on mobile phones worth US$30 on ID card will be Rs550. Taxes and duties on mobile phones worth more than $350 to $500 will be Rs23,240 and 17% sales tax will also have to be paid.

According to the tax tariff issued by the FBR, passengers coming to Pakistan have to pay Rs 430 fixed tax on phones worth up to Doller 30, Rs 3200 fixed tax on phones worth 31 31 to 100, and up to Doller 30 on registration through their passport. On phones worth 100 100 to 200 200, you have to pay a fixed test of Rs. 9580.

PTA Mobile Registration Fee

Mobile phones worth 201 201 to 350 350 will have to pay 17% sales tax in addition to Rs 12,200 customs duty, phones worth 35 351 to 500 500 will be subject to 17% sales tax in addition to Rs 17,800 customs duty.

Mobile phones worth more than 500 500 will have to pay Rs 27,600 plus customs duty and 17% of the phone value as sales tax. PTA Unauthorized Mobile device blocking deadline Date is not extended.

For all commercials entities wishing to import mobile devices for sell/market within Pakistan, prior to import check PTA approved models with TAC details. Only PTA approved devices/TAC will be issued CoC for commercial import.

To check list of approved provided TACs. PTA Approved Mobile Device (Having SIM/IMEI Functionality).

| غیر رجسٹرڈ آئی فون کے پرانے ماڈلز کی رجسٹریشن فیس | |

| 38ہزار922روپے | پاسپورٹ پرآئی فون8کی فیس |

| 48ہزار314 روپے | این آئی سی پر آئی فون8کی فیس |

| 40 ہزار951 روپے | پاسپورٹ پر آئی فون8پلس کی فیس |

| 50 ہزار546 روپے | این آئی سی پر آئی فون8 پلس کی فیس |

Send a text message on 8484 from your registered mobile phone containing IMEI numbers of the handset you are going to purchase and the reply will tell you the status of IMEI.

Kindly ensure to both displayed IMEI’s are programmed in the device prior to use of said device, in case of both IMEI not belonging to same device, such devices are subject to blocking and legal action.

Buy/Sell this mobile device at your own risk as it is registered under individual CNIC/Passport. Please check both IMEIs in case of dual/digital sim device .

AWAM PK – Current Jobs & News for Awam of Pakistan AWAM PK Latest News, Results, Jobs, Sports, images, All Prices in Pakistan

AWAM PK – Current Jobs & News for Awam of Pakistan AWAM PK Latest News, Results, Jobs, Sports, images, All Prices in Pakistan