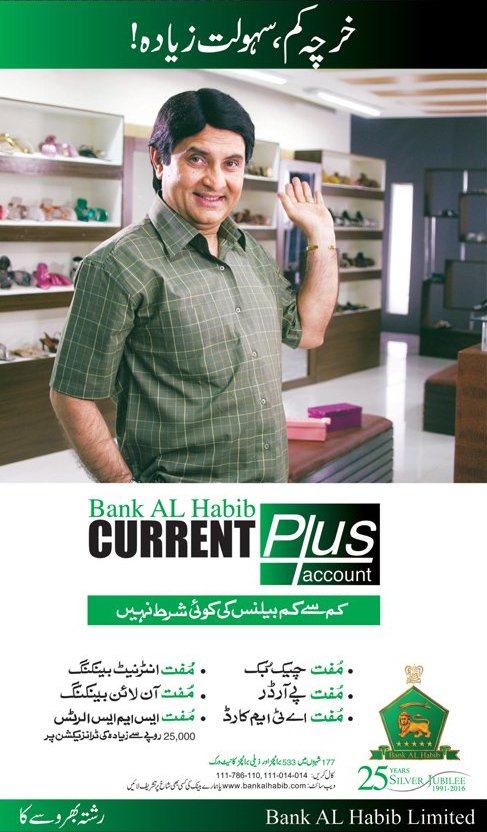

Bank AL Habib Limited Current Plus Account

Bank al habib starts current account and their information is given on this page. Bank AL Habib Limited

RULES / TERMS AND CONDITIONS:

Schedule of Bank Charges.

Identification document the Account Holder is required.

The Bank shall determine from time to time the rate of return/profit payable on the account/deposit in accordance with the prevailing rules and regulations of the State Bank of Pakistan and the policies of the Bank which are subject to change and the Account Holder agrees to accept such rate of return/profit.

Bank AL Habib Current Plus Account Key Features:

A current account that meets all business and individuals needs Offers various free facilities on maintenance of average monthly balance of Rs. 20,000/- including:Free ATM Card Free Pay Orders Free Online Banking Free Personalized Cheque Books Free Internet Banking.Free SMS Alerts on transactions above Rs. 25,000

Rules/Terms and Conditions:

For more information Please visit www.bankalhabib.com

or call on this number 111-786-110-111-014-014.

RULES / TERMS AND CONDITIONS Bank AL Habib Limited

General

1. Any person(s) opening or operating an account with Bank AL Habib Limited (Bank) will be deemed to have read, understood and accepted each of the Rules/Terms and Conditions of Account [set forth herein] and the applicable Schedule of Bank Charges as issued and amended from time to time by the Bank posted on the Bank’s website and displayed on the notice boards of the bank’s branches.

2. No account shall be opened by the Bank unless it is either properly introduced or a satisfactory bank reference is provided and is acceptable to the Bank.

3. The person(s) opening the account will also be required to provide proper identity documents as per regulatory requirement. On expiry of any identification document the Account Holder is required to renew the same and provide the Bank with copies of the same.

4. All accounts maintained with the Bank are governed by and subject to the policies of the Bank in force from time to time and all applicable circulars, orders, directives, rules, regulations, decrees and restrictions issued by the State Bank of Pakistan and other competent governmental and regulatory authorities in Pakistan.

5. The Account Holder should immediately advise the Bank as soon as he/she leaves the country for residence abroad. On receipt of such information the account will be re-designated as a non-resident account and all deposits and withdrawals will be subject to the State Bank of Pakistan rules and regulations applicable from time to time with regard to non-resident accounts.

6. In the absence of a contract to the contrary, the credit balance in any joint account, in the names of two or more persons will in the event of death of any one or more of the Account Holders, become payable to the survivor or survivors in terms of the mandate of the account without reference to the heirs of the deceased person or persons.

7. In case of death of an individual Account Holder/receipt holder, any withdrawal/ payment will be effected to the legal heir(s), executor(s),

administrator(s) or other such personal representative of the Account Holder, only on the production and in terms of a valid succession certificate/letters of probate/ administration issued by a competent court of law or its equivalent.

8. In case of any dispute between joint Account Holders or upon receiving conflicting instructions from any joint Account Holders, the Bank upon receiving any such intimation/conflicting instructions, shall be entitled to stop all transactions in the joint account(s) entirely at the risk and responsibility of the Account Holders.

9. The Bank may from time to time prescribe a minimum deposit/account balance in line with prevailing regulatory requirements which the Account Holder shall maintain in the account at all times.

10. A distinctive number will be allotted by the Bank to each account/receipt which shall be quoted in all correspondence relating to the account and at the time of making deposits or withdrawals. The Bank reserves the right not to act on instructions which do not quote the said number.

11. Any change in the address of the Account Holder should immediately be communicated to the Bank in writing. The Bank shall not be liable for any direct or indirect loss or damage caused as a result of the failure of the Account Holder to send intimation in writing of a change in address. No responsibility whatsoever, shall be accepted by the Bank for delay, non-delivery of Statements of Account, letters, advices etc.

12. The Account Holder shall be liable to pay commission, and all other applicable costs and charges as required and determined by the Bank from time to time in the Schedule of Bank Charges. The Bank reserves the right without prior notice to the Account Holder to debit the account for any expenses, fees, commission, markup/interest, zakat, withholding tax, stamp duty, excise duty or any other costs, charges, expenses, taxes or duties arising out of any transactions or operations in the account or dealings with the Bank or payable to the provincial or federal government as may be levied from time to time.

13. The Bank reserves the right to amend and/or revise these rules/terms and conditions from time to time. Such amendments shall be notified to the Account Holder(s)/customer(s) thirty (30) days in advance of the amendments coming into effect. Such amendments/ revisions to these rules/terms and conditions of account shall be intimated to the Account Holder(s) by means of a written notice or by display in the premises of the Bank’s branch maintaining the account. The amended rules shall be deemed to have been accepted by the Account Holder(s) upon such display of the written notice containing the amendments unless the Account Holder(s) objects thereto in writing. Any objections must be received by the Bank within one (1) month from the date of notification of the amendments and if the Account Holder(s) and the Bank fail to resolve the issue within a reasonable time, either of them shall be at liberty to terminate the banking relationship. However the Bank shall be at liberty to amend the Rules to comply with regulatory requirements of the State Bank of Pakistan without any prior notice to the Account Holder.

14. The Bank is authorized to make such disclosures in respect of the accounts as may be required by any court order or competent authority under the provisions of applicable laws and/or otherwise to safeguard the interests of the Bank.

15. In the event that the Account Holder is in breach of its obligations in respect of the Account, Internet Banking ID and ATM PIN as a result thereof, the Bank retains advocates/lawyers to enforce any of its rights or take other steps concerning the account, the Account Holder shall pay to the Bank all costs, charges, fees and expenses incidental thereto on a full indemnity basis and the Bank shall be entitled to debit the account for such costs, charges, fees and expenses.

16. The Bank shall issue periodical statements of accounts to the concerned Account Holder. The Account Holder will notify the Bank in writing of any error, irregularities or omissions that may be discovered, among other things, improper debits/credits within 45 days of the Bank issuing the statement. In case of failure to notify the Bank and upon expiry of such 45 days period, it will be finally and conclusively accepted between the Bank and the Account Holder(s) that the balance in the account and the transactions reflected in the account are true and correct, that the Account Holder releases the Bank, its officers, employees and agents from all claims in connection with the statement; and that the Bank may correct any erroneous posting of entries in the account and inform the Account Holder subsequently.

17. Accounts on which no transaction is done are marked “Dormant” after 1 year of inactivity. Dormancy Condition can only be removed if all Account Holder(s) visits the branch personally with identity documents as per regulatory requirements and conducts a transaction (deposit or withdrawal) on the account the same day. Accounts that remain inoperative for a period of ten years shall be classified as “unclaimed” and surrendered to SBP as per the provisions of the Banking Companies Ordinance.

18. If the account shows a zero balance for six months it will be closed. Furthermore, all instructions of the State Bank of Pakistan relating to Dormant Accounts shall apply.

19. The Account Holder availing of Internet or Electronic Banking, Mobile telephone Banking, SMS Alerts, eMail Statements, and ATM/Debit Cards (herein collectively referred to as “Services”) assumes full responsibility for the confidentiality of his/her Personal Identification Number, Password and User Identification, and also for the security and safe-keeping of his/her computers, mobile telephones and ATM/Debit Cards. The Account Holder acknowledges and accepts that the “Services” carry risk of delays, errors, viruses, breakdowns, interruptions, interceptions, malfunctions, non-availability, late delivery, non-delivery, mis-delivery, unauthorized access, unauthorized use, loss of confidentiality etc. The Account Holder shall avail of the “Services” entirely at his/her risk and responsibility, and shall not hold the Bank responsible or liable for any loss or damage that may be incurred by the Account Holder on account of or relating to the “Services”. The Account Holder agrees to be bound by the terms and conditions of the “Services”, issued by the Bank from time to time. By opting for email statements, the Account Holder waives the requirement to send printed statements to the Account Holder.

20. The Account Holder shall indemnify and hold the Bank harmless at all times and from time to time from and against all losses, liabilities, damages, demands, actions, suits, proceedings, accounts, claims, costs, charges, fees and expenses that the Bank may incur, sustain or be put to including without limitation, legal fees and disbursements reasonably incurred by the Bank, arising from the Bank acting or not acting upon any instruction or information given to the Bank in accordance with these Rules. This indemnity will be in addition to any other indemnity or assurance against loss that the Account Holder may provide to the Bank.

21. If any clause of these Rules is found by a Court in Pakistan or any other competent governmental/regulatory authority to be void or unenforceable, that clause will be severed without affecting any other provisions of these Rules.

22. The Bank may at any time(s) in its discretion and without notice assert a lien and/or exercise a right of set off on any balance outstanding to the credit of the account and apply any part thereof to reduce any indebtedness of whatsoever nature that may be owing to the Bank in name of Account Holder(s).

23. No interest/ return/profit is paid on current accounts.

24. All sums for credit to an account should be accompanied by a deposit slip showing the name and number of the account to be credited. Acknowledgment of receipt of cash and instruments will be valid if printed by the Bank’s System or signed and stamped by the Bank’s Officer. The depositor should satisfy himself that the transaction is so verified on the customer’s copy of the deposit slip. All cheques and other instruments should be crossed before they are paid in for credit to an account.

25. When not in use, cheque books should be kept under lock and key. Loss of a cheque book or any of the cheques should immediately be notified to the Bank in writing. Failure to notify the Bank will automatically discharge the Bank from all responsibilities.

26. The Bank reserves the right to close, without prior notice, any account which in its opinion is not being satisfactorily conducted/operated upon, or for any other reason whatsoever, which the Bank shall not be obliged to disclose.

27. The Account Holder will either have in place or will immediately put in place, systems, procedures and controls effective to prevent and/ or detect thefts of, and forgeries and frauds involving instruments. The Account Holder will immediately report to the Bank any loss or theft of instruments or any other circumstances from which one may reasonably infer that a fraud may be perpetrated.

28. The customer undertakes to keep any cheque books and other monetary instruments issued by the Bank safely and securely at all times. The customer shall exercise due care and prudence in order to ensure that all cheques, cheque books and monetary instruments issued by the Bank are not stolen, misappropriated or used for any unauthorized purpose. The Bank shall not be liable for any loss or liability that may occur in connection with the customer’s failure to exercise proper care. In the event that cheques are stolen from or lost by any customer or forged, the customer shall immediately notify the Bank and issue stop-payment instructions to the Bank. Loss of cheque books should be immediately notified to the Bank by the customer. If the customer reports loss/ theft of a cheque book, before it has been paid, he/ she shall not be held liable for any loss or damage resulting from the payment of the relevant cheque and the Bank shall take reasonable precautions to safeguard the customer’s interest.

29. The Bank will use reasonable efforts to monitor its telephone and fax facilities to determine if it has received any instructions or information from the Account Holder, provided that the Bank is authorised by the Account Holder to act upon telephone and fax instructions received from the Account Holder. The Bank’s ability to act upon telephone and fax instructions depends upon the normal functioning of the various communication facilities used by the Bank. The Bank is not responsible for any delay or failure to receive telephone or fax instructions or information.

30. The Bank shall not be liable in any manner whatsoever, for any direct or indirect damages, losses, costs, expenses, fees or penalties incurred or sustained by the depositor or the Account Holder, due to any delays or errors which may be caused by circumstances beyond the control of the Bank. The respective rights and obligations of the Bank, the Account Holders and the depositor in respect of the deposit, shall be subject to the laws of the Islamic Republic of Pakistan including the directives of the State Bank of Pakistan.

31. The Bank does not act as a trustee at any time.

32. The Bank reserves the right to issue cheque books and/or fresh cheque forms only to persons properly introduced or known to the Bank who continue to conduct their accounts satisfactorily and maintain required minimum balances in line with prevailing regulatory requirements, in their accounts at all times.

33. An Account Holder can only withdraw sums from his account by means of cheques issued to him by the Bank for that particular account and

ATM/Visa Debit Cards issued by the Bank or Internet Banking. Deposits are payable only at the branch of the Bank, where such deposits are made. Online withdrawals are allowed as per rules, but may be withdrawn at any time without notice. The account, however, will be debited for any levies paid to the Government of Pakistan.

34. Cheques should be signed as per the specimen signature supplied to the Bank and any alterations in the cheque must be authenticated by the drawer’s full signature.

35. Post dated and stale cheques shall not be paid and or accepted for collection.

36. The Bank may only accept for collection cheques and other instruments payable to the Account Holder himself at his risk. All cheques and other instruments should be crossed before they are paid in for credit to an account. Un-cleared items though credited in the account shall not be drawn against until proceeds realized. Further, even if such items are credited and/or allowed to be drawn against, the Bank shall have the right to debit the customer’s account if these are not realized.

37. An Account Holder wishing to close an account must return any unused cheques and ATM/Visa Debit cards to the Bank for cancellation after withdrawal of the balance in the account.

38. An account may be transferred free of charge from one branch to another branch of the Bank on the customer’s request, without affecting the profit/ loss accruing position of the account as the concerned accumulated products on credit balances in such PLS accounts for the unaccounted period would also be transferred to the recipient branch along-with the credit balance on the date of transfer.

39. All accounts will be governed by the Laws and Regulations of the Islamic Republic of Pakistan. As regards other matters, not specifically mentioned in these Rules, these will be subject to prevailing Rules of the Bank.

40. The Bank shall determine from time to time the rate of return/profit payable on the account/deposit in accordance with the prevailing rules and regulations of the State Bank of Pakistan and the policies of the Bank which are subject to change and the Account Holder agrees to accept such rate of return/profit.

41. The Bank would be within its rights to make investment of the credit balances/deposits in such accounts held by it in any manner at its sole discretion and to make use of the funds to the best of its judgment in the banking business under the PLS system.

42. The profit/loss earned/incurred on such accounts will be credited/debited as determined by the Bank at its sole discretion on the basis of its net working results at the end of each half-year within a reasonable time from the date of the close of half-yearly/yearly books of accounts of the Bank under intimation to the Account Holders. In case no profit is declared by the Bank then none shall be payable to the Account Holder. In the event of the Bank declaring a loss, the Account Holder shall share in the loss pro rata.

43. The Account Holder will reimburse the Bank with any claims in respect of losses/charges on the basis of half yearly/ yearly closing of the Bank’s books of accounts as applicable to such accounts. The Bank would be within its rights to debit the account for the amount(s) of such claim/charges in settlement of the business accounts of the Bank.

44. The method of calculating return/profit on Profit & Loss Saving Accounts will be based on average monthly balances calculated on daily balances existing between the close of business on the first and last day of the month.

45. Return/profit on PLS Savings Accounts closed before June and December will be paid for the relevant period, at the indicative rates. All return/profit shall be of a provisional nature until finalized by the Bank. Specific Rules for Treasurers Call Accounts

46. The PLS Treasurers Call Accounts are opened for individuals (single or joint), charitable institutions, provident and other funds of benevolent nature of local bodies, autonomous corporations, companies, associations, educational institutions, firms etc. (except commercial banks, airlines, shipping companies, investment banks, leasing companies, modaraba companies) and in all other cases where the accounts are to be opened under the order of a competent Court of Law.

47. The account may be opened with a minimum deposit of an amount that may be prescribed by the Bank from time to time. There is no limit on maximum amount that can be deposited in the account. However for withdrawals at least 24 hours notice should be given. If the balance in the account falls below the prescribed amount no profit will accrue in the account for that particular day.

48. Profit at prescribed tiered rates shall be paid. Such profit shall be calculated on the basis of aggregate products of daily closing balance in the account and credited to the customer’s account on the first working day of the following month.

Specific Rules for Monthly Saver’s Accounts

49. The profit will be paid on the first working day of the following month. The method of calculating return/profit on Saving Account under Monthly Saver’s will be based on average monthly balances for each calendar month calculated on daily balances existing between the close of business on the 1st and last day of the month.

Specific Rules for AL Habib Senior Citizens’ PLS Savings Accounts

50. AL Habib Senior Citizens’ PLS Savings Accounts may be opened in Pak Rupees by individuals (single or joint), in which the primary Account Holder must have attained the age of 60 years as evidenced by the Original CNIC(s) presented and subsequent verification of details from NADRA. Joint Accounts may be opened up-to the limit of 4 Account Holders.

51. Profit on AL Habib Senior Citizens’ PLS Savings Account will be based on average monthly balances for each calendar month calculated on daily balances existing between the close of business on the 1st and last day of the month and paid at the indicative rates so declared and published by the Bank for the relevant period.

52. AL Habib Senior Citizens’ PLS Savings Accounts may be held in Pak Rupees only.

53. Profit on AL Habib Senior Citizens’ PLS Savings Accounts will be paid on the first working day of each following month.

1. Any person(s) opening or operating an account with Bank AL Habib Limited (Bank) will be deemed to have read, understood and accepted each of the Rules/Terms and Conditions of Account [set forth herein] and the applicable Schedule of Bank Charges as issued and amended from time to time by the Bank posted on the Bank’s website and displayed on the notice boards of the bank’s branches.

2. No account shall be opened by the Bank unless it is either properly introduced or a satisfactory bank reference is provided and is acceptable to the Bank.

3. The person(s) opening the account will also be required to provide proper identity documents as per regulatory requirement. On expiry of any identification document the Account Holder is required to renew the same and provide the Bank with copies of the same.

4. All accounts maintained with the Bank are governed by and subject to the policies of the Bank in force from time to time and all applicable circulars, orders, directives, rules, regulations, decrees and restrictions issued by the State Bank of Pakistan and other competent governmental and regulatory authorities in Pakistan.

5. The Account Holder should immediately advise the Bank as soon as he/she leaves the country for residence abroad. On receipt of such information the account will be re-designated as a non-resident account and all deposits and withdrawals will be subject to the State Bank of Pakistan rules and regulations applicable from time to time with regard to non-resident accounts.

6. In the absence of a contract to the contrary, the credit balance in any joint account, in the names of two or more persons will in the event of death of any one or more of the Account Holders, become payable to the survivor or survivors in terms of the mandate of the account without reference to the heirs of the deceased person or persons.

7. In case of death of an individual Account Holder/receipt holder, any withdrawal/ payment will be effected to the legal heir(s), executor(s), administrator(s) or other such personal representative of the Account Holder, only on the production and in terms of a valid succession certificate/letters of probate/ administration issued by a competent court of law or its equivalent.

8. In case of any dispute between joint Account Holders or upon receiving conflicting instructions from any joint Account Holders, the Bank upon receiving any such intimation/conflicting instructions, shall be entitled to stop all transactions in the joint account(s) entirely at the risk and responsibility of the Account Holders.

9. The Bank may from time to time prescribe a minimum deposit/account balance in line with prevailing regulatory requirements which the Account Holder shall maintain in the account at all times.

10. A distinctive number will be allotted by the Bank to each account/receipt which shall be quoted in all correspondence relating to the account and at the time of making deposits or withdrawals. The Bank reserves the right not to act on instructions which do not quote the said number.

11. Any change in the address of the Account Holder should immediately be communicated to the Bank in writing. The Bank shall not be liable for any direct or indirect loss or damage caused as a result of the failure of the Account Holder to send intimation in writing of a change in address.

No responsibility whatsoever, shall be accepted by the Bank for delay, non-delivery of Statements of Account, letters, advices etc.

12. The Account Holder shall be liable to pay commission, and all other applicable costs and charges as required and determined by the Bank from time to time in the Schedule of Bank Charges. The Bank reserves the right without prior notice to the Account Holder to debit the account for any expenses, fees, commission, markup/interest, zakat, withholding tax, stamp duty, excise duty or any other costs, charges, expenses, taxes or duties arising out of any transactions or operations in the account or dealings with the Bank or payable to the provincial or federal government as may be levied from time to time.

13. The Bank reserves the right to amend and/or revise these rules/terms and conditions from time to time. Such amendments shall be notified to the Account Holder(s)/customer(s) thirty (30) days in advance of the amendments coming into effect. Such amendments/ revisions to these rules/terms and conditions of account shall be intimated to the Account Holder(s) by means of a written notice or by display in the premises of the Bank’s branch maintaining the account. The amended rules shall be deemed to have been accepted by the Account Holder(s) upon such display of the written notice containing the amendments unless the Account Holder(s) objects thereto in writing. Any objections must be received by the Bank within one (1) month from the date of notification of the amendments and if the Account Holder(s) and the Bank fail to resolve the issue within a reasonable time, either of them shall be at liberty to terminate the banking relationship. However the Bank shall be at liberty to amend the Rules to comply with regulatory requirements of the State Bank of Pakistan without any prior notice to the Account Holder.

14. The Bank is authorized to make such disclosures in respect of the accounts as may be required by any court order or competent authority under the provisions of applicable laws and/or otherwise to safeguard the interests of the Bank.

15. In the event that the Account Holder is in breach of its obligations in respect of the Account, Internet Banking ID and ATM PIN as a result thereof, the Bank retains advocates/lawyers to enforce any of its rights or take other steps concerning the account, the Account Holder shall pay to the Bank all costs, charges, fees and expenses incidental thereto on a full indemnity basis and the Bank shall be entitled to debit the account for such costs, charges, fees and expenses.

16. The Bank shall issue periodical statements of accounts to the concerned Account Holder. The Account Holder will notify the Bank in writing of any error, irregularities or omissions that may be discovered, among other things, improper debits/credits within 45 days of the Bank issuing the statement. In case of failure to notify the Bank and upon expiry of such 45 days period, it will be finally and conclusively accepted between the Bank and the Account Holder(s) that the balance in the account and the transactions reflected in the account are true and correct, that the Account Holder releases the Bank, its officers, employees and agents from all claims in connection with the statement; and that the Bank may correct any erroneous posting of entries in the account and inform the Account Holder subsequently.

17. Accounts on which no transaction is done are marked “Dormant” after 1 year of inactivity. Dormancy Condition can only be removed if all Account Holder(s) visits the branch personally with identity documents as per regulatory requirements and conducts a transaction (deposit or withdrawal) on the account the same day. Accounts that remain inoperative for a period of ten years shall be classified as “unclaimed” and surrendered to SBP as per the provisions of the Banking Companies Ordinance.

18. If the account shows a zero balance for six months it will be closed. Furthermore, all instructions of the State Bank of Pakistan relating to Dormant Accounts shall apply.

19. The Account Holder availing of Internet or Electronic Banking, Mobile telephone Banking, SMS Alerts, eMail Statements, and ATM/Debit Cards (herein collectively referred to as “Services”) assumes full responsibility for the confidentiality of his/her Personal Identification Number, Password and User Identification, and also for the security and safe-keeping of his/her computers, mobile telephones and ATM/Debit Cards. The Account Holder acknowledges and accepts that the “Services” carry risk of delays, errors, viruses, breakdowns, interruptions, interceptions, malfunctions, non-availability, late delivery, non-delivery, mis-delivery, unauthorized access, unauthorized use, loss of confidentiality etc. The Account Holder shall avail of the “Services” entirely at his/her risk and responsibility, and shall not hold the Bank responsible or liable for any loss or damage that may be incurred by the Account Holder on account of or relating to the “Services”. The Account Holder agrees to be bound by the terms and conditions of the “Services”, issued by the Bank from time to time. By opting for email statements, the Account Holder waives the requirement to send printed statements to the Account Holder.

20. The Account Holder shall indemnify and hold the Bank harmless at all times and from time to time from and against all losses, liabilities, damages, demands, actions, suits, proceedings, accounts, claims, costs, charges, fees and expenses that the Bank may incur, sustain or be put to including without limitation, legal fees and disbursements reasonably incurred by the Bank, arising from the Bank acting or not acting upon any instruction or information given to the Bank in accordance with these Rules. This indemnity will be in addition to any other indemnity or assurance against loss that the Account Holder may provide to the Bank.

21. If any clause of these Rules is found by a Court in Pakistan or any other competent governmental/regulatory authority to be void or unenforceable, that clause will be severed without affecting any other provisions of these Rules.

22. The Bank may at any time(s) in its discretion and without notice assert a lien and/or exercise a right of set off on any balance outstanding to the credit of the account and apply any part thereof to reduce any indebtedness of whatsoever nature that may be owing to the Bank in name of Account Holder(s).

23. No interest/ return/profit is paid on current accounts.

24. All sums for credit to an account should be accompanied by a deposit slip showing the name and number of the account to be credited. Acknowledgment of receipt of cash and instruments will be valid if printed by the Bank’s System or signed and stamped by the Bank’s Officer. The depositor should satisfy himself that the transaction is so verified on the customer’s copy of the deposit slip. All cheques and other instruments should be crossed before they are paid in for credit to an account.

25. When not in use, cheque books should be kept under lock and key. Loss of a cheque book or any of the cheques should immediately be notified to the Bank in writing. Failure to notify the Bank will automatically discharge the Bank from all responsibilities.

26. The Bank reserves the right to close, without prior notice, any account which in its opinion is not being satisfactorily conducted/operated upon, or for any other reason whatsoever, which the Bank shall not be obliged to disclose.

27. The Account Holder will either have in place or will immediately put in place, systems, procedures and controls effective to prevent and/ or detect thefts of, and forgeries and frauds involving instruments. The Account Holder will immediately report to the Bank any loss or theft of instruments or any other circumstances from which one may reasonably infer that a fraud may be perpetrated.

28. The customer undertakes to keep any cheque books and other monetary instruments issued by the Bank safely and securely at all times. The

customer shall exercise due care and prudence in order to ensure that all cheques, cheque books and monetary instruments issued by the Bank are not stolen, misappropriated or used for any unauthorized purpose. The Bank shall not be liable for any loss or liability that may occur in connection with the customer’s failure to exercise proper care. In the event that cheques are stolen from or lost by any customer or forged, the customer shall immediately notify the Bank and issue stop-payment instructions to the Bank. Loss of cheque books should be immediately

notified to the Bank by the customer. If the customer reports loss/ theft of a cheque book, before it has been paid, he/ she shall not be held liable for any loss or damage resulting from the payment of the relevant cheque and the Bank shall take reasonable precautions to safeguard the customer’s interest.

29. The Bank will use reasonable efforts to monitor its telephone and fax facilities to determine if it has received any instructions or information from the Account Holder, provided that the Bank is authorised by the Account Holder to act upon telephone and fax instructions received from the Account Holder. The Bank’s ability to act upon telephone and fax instructions depends upon the normal functioning of the various communication facilities used by the Bank. The Bank is not responsible for any delay or failure to receive telephone or fax instructions or information.

30. The Bank shall not be liable in any manner whatsoever, for any direct or indirect damages, losses, costs, expenses, fees or penalties incurred or sustained by the depositor or the Account Holder, due to any delays or errors which may be caused by circumstances beyond the control of the Bank. The respective rights and obligations of the Bank, the Account Holders and the depositor in respect of the deposit, shall be subject to the laws of the Islamic Republic of Pakistan including the directives of the State Bank of Pakistan.

31. The Bank does not act as a trustee at any time.

32. The Bank reserves the right to issue cheque books and/or fresh cheque forms only to persons properly introduced or known to the Bank who continue to conduct their accounts satisfactorily and maintain required minimum balances in line with prevailing regulatory requirements, in their accounts at all times.

33. An Account Holder can only withdraw sums from his account by means of cheques issued to him by the Bank for that particular account and ATM/Visa Debit Cards issued by the Bank or Internet Banking. Deposits are payable only at the branch of the Bank, where such deposits are made. Online withdrawals are allowed as per rules, but may be withdrawn at any time without notice. The account, however, will be debited for any levies paid to the Government of Pakistan.

34. Cheques should be signed as per the specimen signature supplied to the Bank and any alterations in the cheque must be authenticated by

the drawer’s full signature.

35. Post dated and stale cheques shall not be paid and or accepted for collection.

36. The Bank may only accept for collection cheques and other instruments payable to the Account Holder himself at his risk. All cheques and other instruments should be crossed before they are paid in for credit to an account. Un-cleared items though credited in the account shall not be drawn against until proceeds realized. Further, even if such items are credited and/or allowed to be drawn against, the Bank shall have the right to debit the customer’s account if these are not realized.

37. An Account Holder wishing to close an account must return any unused cheques and ATM/Visa Debit cards to the Bank for cancellation after withdrawal of the balance in the account.

38. An account may be transferred free of charge from one branch to another branch of the Bank on the customer’s request, without affecting the profit/ loss accruing position of the account as the concerned accumulated products on credit balances in such PLS accounts for the unaccounted period would also be transferred to the recipient branch along-with the credit balance on the date of transfer.

39. All accounts will be governed by the Laws and Regulations of the Islamic Republic of Pakistan. As regards other matters, not specifically mentioned in these Rules, these will be subject to prevailing Rules of the Bank.

40. The Bank shall determine from time to time the rate of return/profit payable on the account/deposit in accordance with the prevailing rules and regulations of the State Bank of Pakistan and the policies of the Bank which are subject to change and the Account Holder agrees to accept such rate of return/profit.

41. The Bank would be within its rights to make investment of the credit balances/deposits in such accounts held by it in any manner at its sole discretion and to make use of the funds to the best of its judgment in the banking business under the PLS system.

42. The profit/loss earned/incurred on such accounts will be credited/debited as determined by the Bank at its sole discretion on the basis of its net working results at the end of each half-year within a reasonable time from the date of the close of half-yearly/yearly books of accounts of the Bank under intimation to the Account Holders. In case no profit is declared by the Bank then none shall be payable to the Account Holder. In the event of the Bank declaring a loss, the Account Holder shall share in the loss pro rata.

43. The Account Holder will reimburse the Bank with any claims in respect of losses/charges on the basis of half yearly/ yearly closing of the Bank’s books of accounts as applicable to such accounts. The Bank would be within its rights to debit the account for the amount(s) of such claim/charges in settlement of the business accounts of the Bank.

44. The method of calculating return/profit on Profit & Loss Saving Accounts will be based on average monthly balances calculated on daily balances existing between the close of business on the first and last day of the month.

45. Return/profit on PLS Savings Accounts closed before June and December will be paid for the relevant period, at the indicative rates. All return/profit shall be of a provisional nature until finalized by the Bank.

46. The PLS Treasurers Call Accounts are opened for individuals (single or joint), charitable institutions, provident and other funds of benevolent nature of local bodies, autonomous corporations, companies, associations, educational institutions, firms etc. (except commercial banks, airlines, shipping companies, investment banks, leasing companies, modaraba companies) and in all other cases where the accounts are to be opened under the order of a competent Court of Law.

47. The account may be opened with a minimum deposit of an amount that may be prescribed by the Bank from time to time. There is no limit on maximum amount that can be deposited in the account. However for withdrawals at least 24 hours notice should be given. If the balance in the account falls below the prescribed amount no profit will accrue in the account for that particular day.

48. Profit at prescribed tiered rates shall be paid. Such profit shall be calculated on the basis of aggregate products of daily closing balance in the account and credited to the customer’s account on the first working day of the following month.

49. The profit will be paid on the first working day of the following month. The method of calculating return/profit on Saving Account under Monthly Saver’s will be based on average monthly balances for each calendar month calculated on daily balances existing between the close of business on the 1st and last day of the month.

Specific Rules for AL Habib Senior Citizens’ PLS Savings Accounts

50. AL Habib Senior Citizens’ PLS Savings Accounts may be opened in Pak Rupees by individuals (single or joint), in which the primary Account Holder must have attained the age of 60 years as evidenced by the Original CNIC(s) presented and subsequent verification of details from NADRA. Joint Accounts may be opened up-to the limit of 4 Account Holders.

51. Profit on AL Habib Senior Citizens’ PLS Savings Account will be based on average monthly balances for each calendar month calculated on daily balances existing between the close of business on the 1st and last day of the month and paid at the indicative rates so declared and published by the Bank for the relevant period.

52. AL Habib Senior Citizens’ PLS Savings Accounts may be held in Pak Rupees only.

53. Profit on AL Habib Senior Citizens’ PLS Savings Accounts will be paid on the first working day of each following month.

AWAM PK – Current Jobs & News for Awam of Pakistan AWAM PK Latest News, Results, Jobs, Sports, images, All Prices in Pakistan

AWAM PK – Current Jobs & News for Awam of Pakistan AWAM PK Latest News, Results, Jobs, Sports, images, All Prices in Pakistan