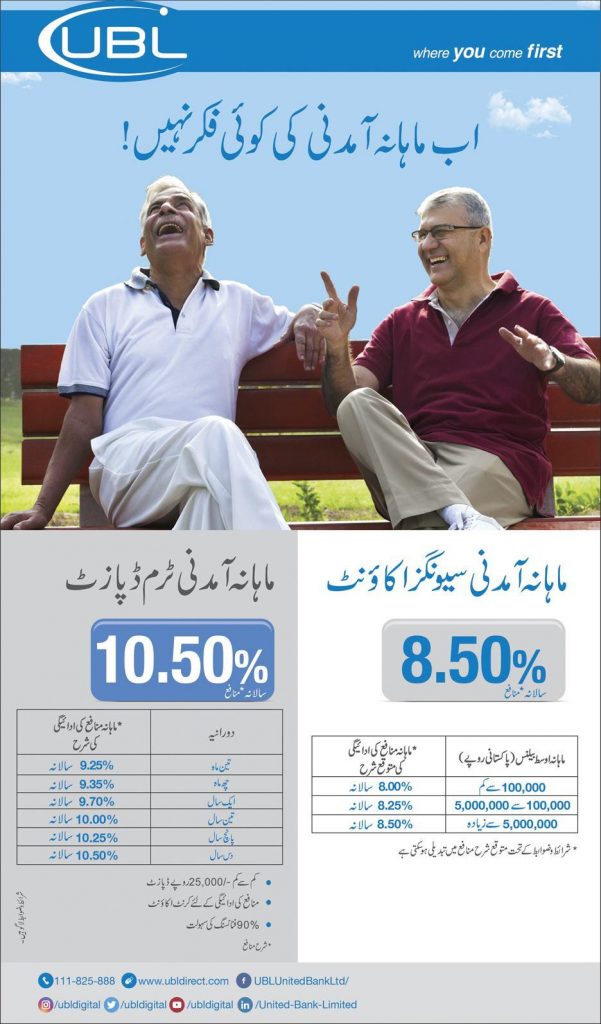

UBL Mahana Aamdani Savings Account

UBL New Savings Account is a unique monthly savings account, offering competitive high yield tier-based saving rates, primarily targeting rate conscious customers, who are also looking for transactional flexibility.

UBL Mahana Munafa Plan is a regular income plan that allows you to invest your savings and get the earnings on your investment as profit on a regular basis. You can opt to receive the profit on a monthly, quarterly, semi-annual or annual basis. The profit amount can be automatically transferred to your bank account or sent to you in the form of a cheque or demand draft.

UBL Mahana Munafa Plan

With rising costs, managing your household expenses can become challenging. With UBL Mahana Munafa Plan you can meet your expenses in time and manage your household without cutting corners.

The minimum amount of investment is Rs. 100,000 only.

The minimum amount for subsequent investments is Rs. 500 only.

You can receive the profit on a monthly, quarterly, semi-annual or annual basis.

The profit amount will be sent to you in the form of a cheque, pay order or will be transferred automatically to your bank account.

You can withdraw your investment in part or whole at any time you want without any penalty or charges. To do this you need to fill out a form and send it to us.

No. Zakat will not be deducted on the submission of an Affidavit.

Eligibility:

UBL Mahana Aamdani Savings Account can be opened by the following:

Individual Single and Joint Accounts Partnerships Joint Stock company Accounts (public/private) Gov’t Institutions (Federal/Provincial) Sole Proprietorship Self Employed Individuals Small and Medium Enterprises Salaried/ Retired Individuals / Pensioners Housewives Foreign Missions/Diplomats and Associations/Clubs/Trusts, etc. Minimum denomination to open this account. This account can be opened with minimum PKR 100/-. Minimum/maximum amount that can be deposited in this account. There is no minimum or maximum balance limit for this account.

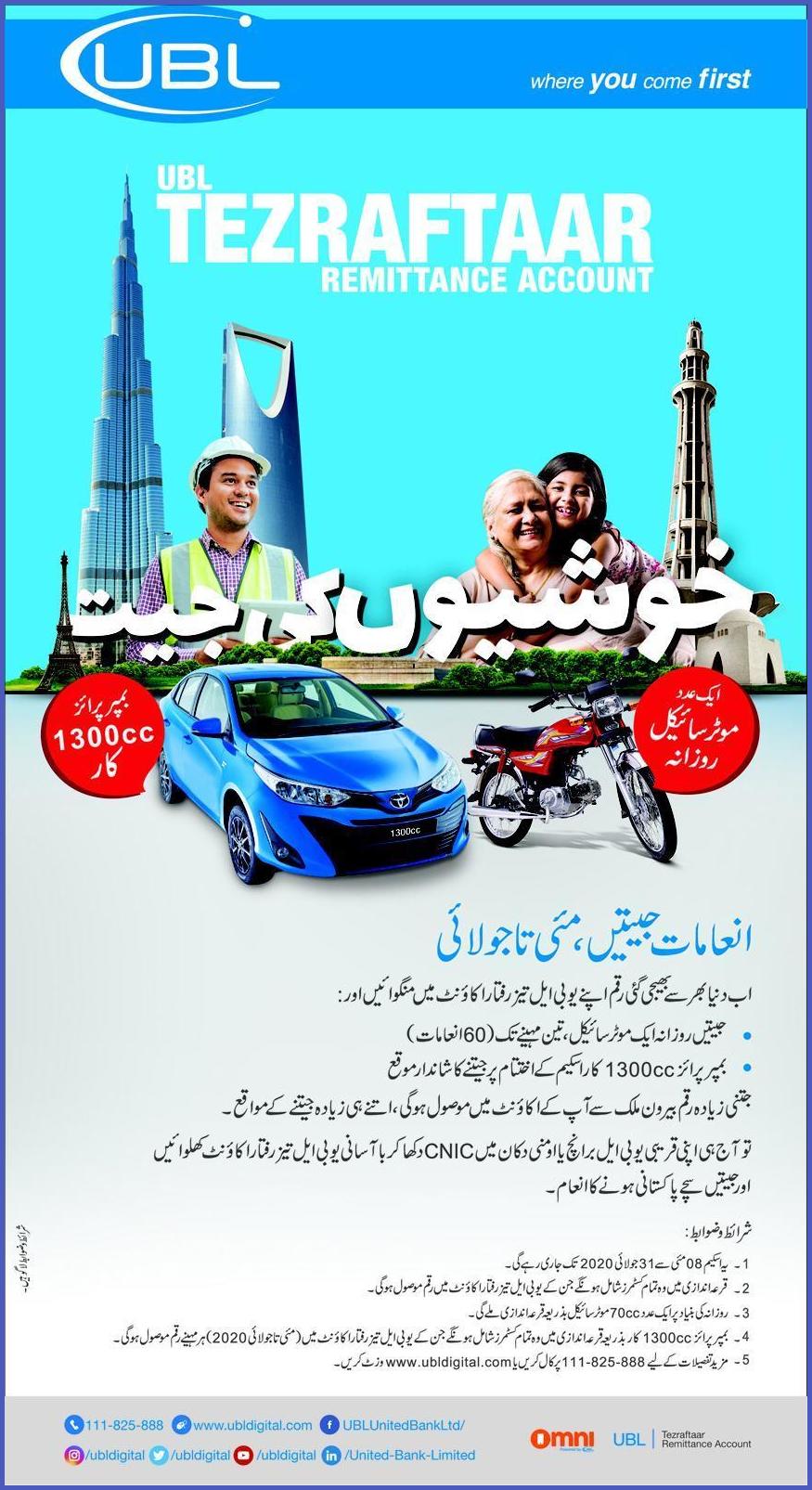

UBL Tezraftaar Remittance Account

Features & Benefits

No fixed-term holding period requirement

Easy access to your money

No charges on withdrawal

Tax savings on income tax deduction (Click Here to find out how)

Minimum investment: Rs. 100,000

AWAM PK – Current Jobs & News for Awam of Pakistan AWAM PK Latest News, Results, Jobs, Sports, images, All Prices in Pakistan

AWAM PK – Current Jobs & News for Awam of Pakistan AWAM PK Latest News, Results, Jobs, Sports, images, All Prices in Pakistan