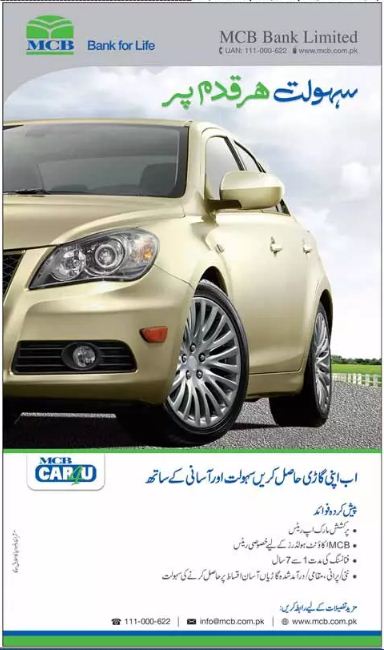

In today’s fast-paced world, owning a car is no longer a luxury but a necessity. As more individuals aspire to own their vehicles, financial assistance becomes crucial. In this context, Muslim Commercial Bank stands out as a reliable option for those seeking a car loan.

With the increasing desire for car ownership, the demand for efficient and affordable car loans has surged. Car loans play a pivotal role in turning the dream of owning a vehicle into reality. They provide the necessary financial support, allowing individuals to acquire their desired cars without hefty upfront payments.

Muslim Commercial Bank Car Loan apply online

Muslim Commercial Bank has introduce Mcb car 4 u scheme 2024 for their customers. MCB Car4U provides a one-stop financing solution to help you own a car of your dreams. Whether you are a salaried professional or a self-employed businessman, MCB Car4U has a complete solution for you. In addition, MCB offers a specially designed Car4U product for agriculturists as well as landlords.

MCB Bank car installment plan 2024

Applying for a car loan at Muslim Commercial Bank is a straightforward and rewarding process. With low-interest rates, flexible repayment options, and a user-friendly online application system, the bank ensures a positive borrowing experience for its customers.

Muslim commercial bank car loan requirements

All MCB account holders who receive overseas remittances regularly from any closely related family member are also eligible to apply for a Car4U finance facility.

MCB Car4U offers competitive rates for all car variants and tenors. Enjoy even a lower mark-up rate if you are already a MCB Bank customer.

Eligibility Criteria:

Minimum monthly net salary / monthly income requirement: PKR 30,000/-

Minimum Age Requirement: 21 years.

Maximum Age (at loan maturity): 65 years (salaried) and 70 (Self Employed)

Employment/Business Length: Minimum 6 months employment (salaried) / 1 year business (self-employed)

Features:

Finance up to PKR 6 Million for New Cars & PKR 4 Million for Used Cards

Finance Tenure from 1 to 7 years

Option to purchase new, used, local as well as imported cars

Finance up to 80% of vehicle value

Competitive insurance rates

Option to finance a second car

Options to prepay loan either partially to reduce monthly installment or in full to pay-off loan facility

Loan Replacement: Customers can easily upgrade their existing cars loan with a new loan with the pre-payment penalty waived

Muslim commercial bank car loan calculator

mcb Islamic car loan calculator, Agriculturists, landlords and foreign remittance recipients are eligible

No processing fee is payable if the loan is not approved

Drive away your car immediately after delivery of the vehicle – no need to wait till registration

140+ approved Auto dealership across the country

Quick processing, through dedicated operations teams in Karachi, Lahore and Islamabad

Quick NOC issuance at the expiry of the loan tenure

Consumer Offices/Customer Walk-in Centers in 12 major cities

Minimum Documentation

Copy of CNIC

2 passport sized recent photographs

Bank statement (6 month to 1 year)

Salary slip/ proof of business or other documents

Muslim commercial bank car loan interest rate

mcb bank car loan interest rate, MCB Car4U can be availed through either of our 140+ approved Car dealers, by visiting any of our Customer Walk-in Centres, through our Call Centre, and/or through a network of 1,050+ Car4U approved branches in the following cities:

Abbottabad, Attock, Bahawalpur, Chakwal, D. G. Khan, Faisalabad, Gujranwala, Gujrat, Hyderabad, Islamabad, Jhang, Jhelum, Karachi, Kohat, Lahore , Larkana, Makran, Mardan, Mianwali ,Multan, Muzaffarabad A.K., Nawabshah, Peshawar, Rahim Yar Khan, Rawalpindi, Sahiwal, Sargodha, Sheikhupura, Sialkot, Sukkur and Vehari, BadinBagh, A.K., Bahawalnagar, Battagram, Bhakkar, Bhimber, Charsadda, Chiniot, Dadu, Faisalabad, Ghotki, Gwadar, Hafizabad, Haripur, Jacobabad, Jaffarabad, Jamshoro, Kambershahdad Kot, Kashmore, Kandhkot, Kasur, Khairpur,Mirs, Khanewal, Khushab, Kotli, Lasbela, Layyah, Lodhran, Malakand, Mandi Bahauddin, Mansehra, Matiari, Mianwali, Mirpur, A.K.Mirpur Khas, Muzaffargarh, Nankana Sahib, Narowal, Naushero Feroze, Nowshera, Okara, Pakpattan, Pishin, Poonch, Rajanpur, Sahiwal, Sanghar, Shaheed Benazirabad, Shikarpur, Sudhnooti, Sujawal, Swabi, Tando Allahyar, Tando Mohammad Khan, Tharparkar, Thatta, Toba Tek Singh, Umerkot and Zhob.

Muslim commercial bank car loan contact number Dial 111-000-622 for Call Center and/or you may also dial 042-35987979 for our Consumer Helpdesk.

Note: All loans shall be processed and approved as per MCB Bank Limited sole discretion in accordance with regulations and Bank’s approved policies and procedures.

AWAM PK – Current Jobs & News for Awam of Pakistan AWAM PK Latest News, Results, Jobs, Sports, images, All Prices in Pakistan

AWAM PK – Current Jobs & News for Awam of Pakistan AWAM PK Latest News, Results, Jobs, Sports, images, All Prices in Pakistan